American Lending Conference Recap: Construction Lending and the Conversations In Between

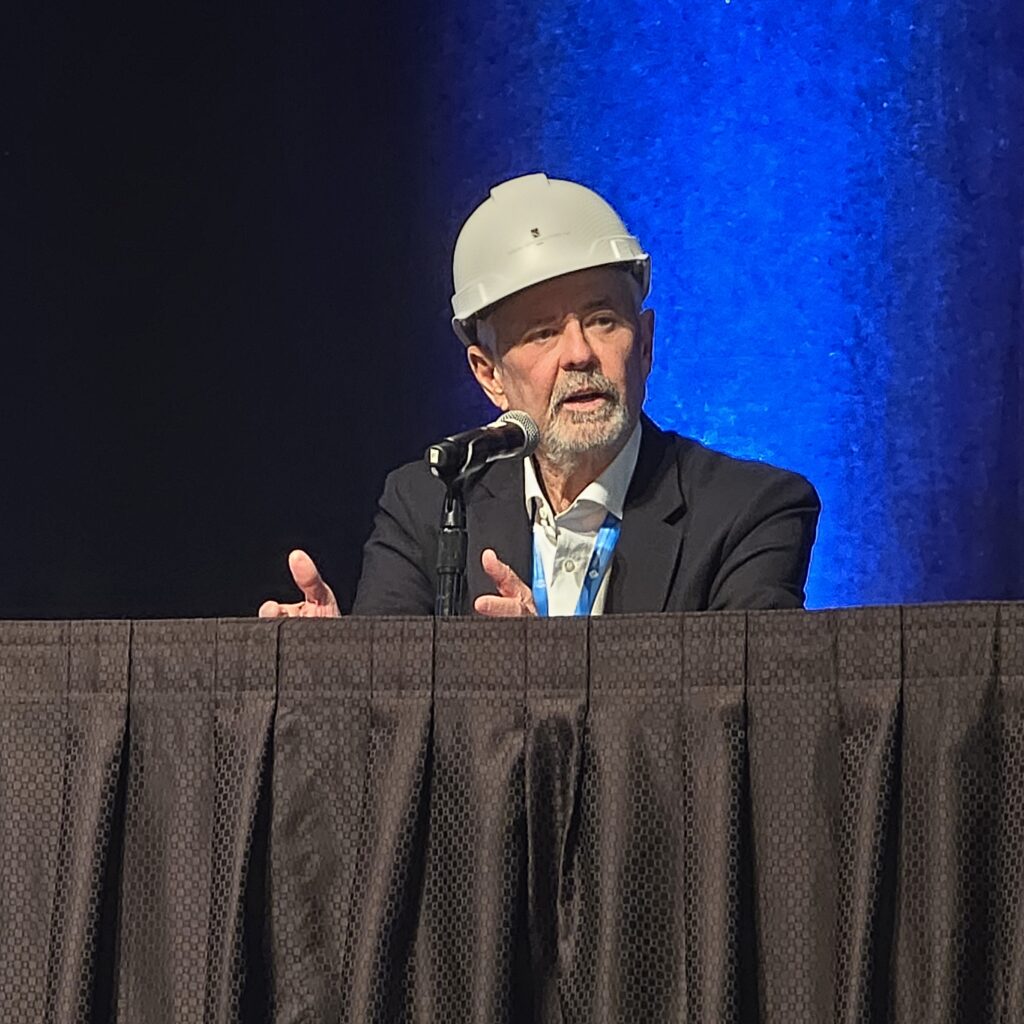

We’re back from the American Lending Conference (ALC), where lenders and industry pros came together to explore new opportunities and address challenges. With the housing shortage continuing to dominate the conversation, Dennis Doss, CEO of Doss Law and Doss Docs, led a session on construction lending that drew strong interest from attendees.

Construction Lending: A Key Opportunity for Lenders

The Construction Lending panel was a focal point of the American Lending Conference, especially as the housing shortage drives demand for new development. During the session, Dennis emphasized that construction lending offers less competition compared to fix-and-flip or DSCR loans and presents a unique opportunity for growth. He explained that launching a construction lending division not only diversifies your business but also builds long-term relationships with homebuilders.

“These builders aren’t just building one home,” Dennis explained. “They’re working on multiple homes and subdivisions year-round. If you take care of them, you’ve got a client for life.” The message resonated: construction lending presents a long-term opportunity for repeat business with reliable clients.

What else were lenders talking about at the American Lending Conference?

Private Debt Funds on The Mind

While construction lending seemed to dominate the conversation at the American Lending Conference, private debt funds were a topic of conversation. Lenders were discussing how these funds could offer more flexibility and scalability, allowing them to grow their portfolios in new ways.

Bridge Loans a Topic of Conversation

Another topic of interest was consumer bridge loans. As borrowers increasingly seek short-term financing between transactions, lenders recognize bridge loans as a creative and flexible solution. These conversations made it clear that bridge loans are a popular option for both lenders and borrowers.

Looking Ahead

Construction lending remains a critical focus, especially with the state of the current housing market. Through these discussions with lenders, it’s also clear that private debt funds and bridge loans are also top of mind. Expect more updates and detailed discussions on these topics. Stay tuned for more!

Doss Law: Simplifying the Complexities of Construction Lending

Doss Law streamlines the mortgage lending process, handling all the legal details so you can focus on what matters most—growing your business. As experts in mortgage lending law, we provide ongoing support for everything from loan document drafting to compliance and fund management.

Whether you’re expanding into construction lending or looking at private debt funds, Doss Law ensures your legal needs are covered every step of the way.

Need help with your next construction lending project? Let us know.